Welcome

DIY BRANDABLE CAMPAIGNS

Everything you need to create your own marketing campaigns using our brandable templates and campaign assets. To get started, click the asset you would like to use below. Highlight and right-click the text, select Copy, and then paste the text into your website, email, or social media sites.

CAMPAIGN ASSETS

Clients have Long-Term Care on their minds, and the legislative activity from the states may be the most effective “marketing” our industry could ask for. The issue is defining an approach that clients can use to evaluate available public options for Long-Term Care.

There is a significant change on the horizon in the Care Planning space. The impact of consumers being unprepared for the cost of care and the corresponding stress this places on existing programs and budgets has led many state governments to take action by introducing legislation that creates a “public option” for Long-Term Care insurance. This coming wave of state-level Long-Term Care legislation puts clients in a tough position: How can they prepare for any new legislation and the associated new income tax while the final form of that legislation remains unknown?

Based on the current state of the most mature LTC legislation from the state of California, a wait-and-see approach carries a very real risk. As currently written, the legislation may offer an opt-out only if consumers have personal Long-Term Care coverage before the law goes into effect. By the time the final details of the legislation are known, however, it could be too late to execute a strategy to allow clients to opt out of the program and avoid any new taxation.

As important as preparing for potential legislation may be, the real risk clients face is not having a care plan as they age, which includes how they want to receive care and how to pay for it. Many consumers feel this risk rather acutely as they care for their own aging parents. Ideally, the potential for new legislation and new taxes will serve as a catalyst for a larger planning conversation that positions clients for any impending legislation and maintains forward-looking planning flexibility.

The current state of the California legislation includes five potential designs, each with its own unique attributes. They vary widely in terms of the benefits they could provide and the corresponding tax. The most robust design could offer the following benefits:

- LTC Benefits of at least $6,000 per month

- A Benefit Period of two years or longer

- An increasing benefit at a 3% compound rate

This level of benefits may represent the minimum standard for personal coverage to qualify for an opt-out of the public option and the corresponding tax. Even if this benefit level represents a “safe harbor” of sorts, it is far from an adequate amount of coverage for the typical claim in many markets, both in terms of monthly benefits and duration of benefits. This highlights the difference between planning for potential legislation and implementing a more comprehensive care planning strategy. Educating clients about the difference may also represent the first step in guiding clients through a decision-making process that addresses both elements of this very real planning challenge. Also, it is critical to consider other designs with longer benefit periods that may be available at similar, if not lower, pricing versus looking exclusively at 2-year benefit periods, even if only seeking the minimum coverage to qualify for a potential opt-out. One of the primary issues with addressing this challenge is viewing it as a point-in-time decision.

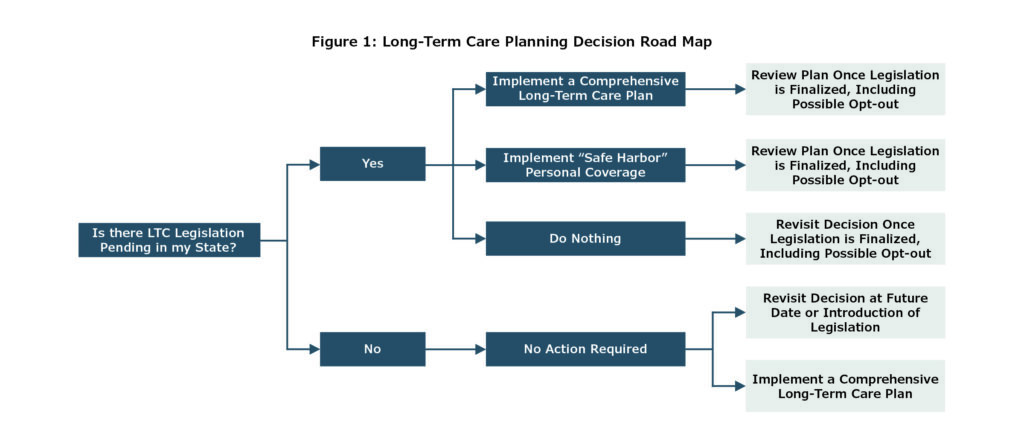

While it is true that clients have a decision to make today that will have downstream consequences, if those consequences are understood in advance, clients can move forward with planning, knowing they are prepared for the next steps. At the same time, regardless of the client’s choice today, the result of a high-quality planning process is the same: Implementation of a plan today, followed by updating their plan once the final form of the legislation is known or at an agreed upon future date.

The next step in the planning process is revisiting the initial decision, either upon introducing new LTC legislation in the client’s state or when the proposed legislation becomes law. At that point, there are three key questions:

- Is the client eligible for an opt-out?

- If so, should the client pursue an opt-out?

- Based on the new legislation and the answer to the prior questions, what changes should be made to the balance of their plan?

These questions are critically important. The second is based on a very healthy question that can be applied to many topics: “Just because you can, doesn’t mean you should.” More specifically, until the final form of any legislation is known, it is impossible to predict if opting out is in the client’s best interest, making this the time to make that decision. Next, reviewing these plans periodically, whether based on changes to outside forces like legislation, costs, and the like or straightforward evolution of the client’s view on the issue, is critical to long-term success. Figure 1, Long-Term Care Planning Decision Road Map, outlines a framework for guiding clients through this series of decisions.

Figure 1: Long-Term Care Planning Decision Road Map

In the case of the client who elected to put the safe harbor approach in place, this is likely the time to make their next decision around their funding plan, either relying on the public option or acquiring additional personal coverage to complete their funding plan. This is also an opportunity to review or address the elements of their care plan for the first time beyond funding the cost of care. This includes:

- Creation of any legal documentation that needs to be in place

- Memorializing how the client would prefer to receive care

- Vetting potential providers, facilities, and more

Having a comprehensive plan that addresses all of these elements long before the need for care presents itself increases the quality of the decision-making process and provides the peace of mind that comes with a high level of confidence in the plan.

It’s important to note that while California has been used as an example for this discussion, this same framework can be applied to any states currently considering similar legislation and any additional states that may pursue a similar path. Further, the California legislation has additional nuances that should also factor into the planning process, and a more comprehensive review of the proposed legislation is highly recommended. Please see Figure 2 for a list of states with current or ending LTC legislation.

Figure 2: States with Current or Pending LTC Legislation

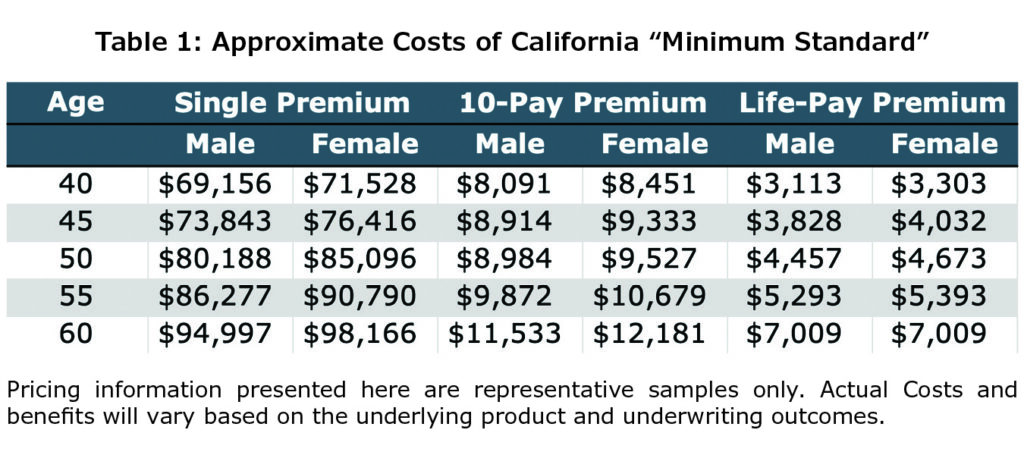

Given the benefit design parameters discussed previously as a potential minimum standard, we can forecast the approximate costs for personal coverage that would meet that standard. These costs are outlined in Table 1 below. This highlights the need to evaluate opting out. The economics of these safe harbor designs may require a greater cash outlay than the public option, driving home the need for real planning, not simply tax avoidance.

Table 1: Approximate Costs of California “Minimum Standard”

Most reading this will recall similar circumstances in Washington driven by the Washington Cares Act. The key difference in California, which is something to watch in other states, is the timing. Specifically, Washington opened an “opt-out window” after the legislation was enacted, allowing advisors and clients to defer any decisions around pursuing an opt-out. The California proposal does not provide any specificity around a deadline for coverage to be in force to qualify for an opt-out. The earliest effective date referenced in the proposal is January 1, 2024. There is also discussion of a “partial opt-out” for California residents who acquire coverage at a later date. These provisions are not finalized, like the balance of the specifics relative to the California law.

While not discussed here, it’s essential to remember the role life insurance products with Long-Term Care or Chronic Illness riders can play in this process. While these products appear less likely to qualify for an opt-out of the California legislation than other products, other states may follow the approach seen in the Washington Cares Act that does not require the COLA provision these products lack. In those instances, it is critical to review the actual language of the legislation in that state for insight into qualifying for an opt-out. Further, suppose the client’s planning needs indicate that a life insurance policy with a rider is the most appropriate solution. In that case, that may supersede qualifying for an opt-out of a public LTC program.

One of the most important lessons from Washington continues to be the impact on product availability. Based on multiple factors, including concerns about persistency and the ability to issue and place policies promptly, many carriers suspended Long-Term Care sales in Washington well before the deadline for policy placement required for an opt-out. Even with those early deadlines, many carriers struggled to issue policies promptly because of the overwhelming application volumes they received. Given the size of the California market, the possibility of a similar set of circumstances is quite accurate. Based on all of these factors, the call to action is to engage clients in an educational and planning process focused on long-term care planning that includes a discussion of any current or potential public options available to them.

Clients and advisors alike are thinking about Long-Term Care, and the legislative activity coming from the states may be the most effective “marketing” our industry could ask for. The issue is defining an approach that guides clients as they evaluate available public options for Long-Term Care. We’ve developed a “decision road map” that addresses this very issue.

Interested in learning more? Let’s chat!

#LongTermCare #LTCLegislation #WashingtonCares

Subject Line: Long-Term Care is Changing—Are You Ready?

There is a significant change on the horizon in the Care Planning space. The impact of consumers being unprepared for the cost of care and the corresponding stress this places on existing programs and budgets has led many state governments to take action by introducing legislation that creates a “public option” for Long-Term Care insurance. This coming wave of state-level Long-Term Care legislation puts clients in a tough position: How can they prepare for any new legislation and the associated new income tax while the final form of that legislation remains unknown?

We’ve developed resources that can help you do just that!

If you want to take a closer look at how we’re designing this strategy with other advisors, contact me for more information.