Welcome

DIY BRANDABLE CAMPAIGNS

Everything you need to create your own marketing campaigns using our brandable templates and campaign assets. To get started, click the asset you would like to use below. Highlight and right-click the text, select Copy, and then paste the text into your website, email, or social media sites.

CAMPAIGN ASSETS

Finding the Middle Ground Between a MYGA and an FIA

One of the fundamental aspects of financial planning is aligning a client’s risk tolerance and time horizon with a suitable product solution. However, this can be challenging when a client’s true appetite for risk falls somewhere between available options, as is often the case in the annuity market.

Anyone who has visited a Disney theme park understands the stark contrast between different rides. It’s a Small World? Predictable and slow. The Mad Tea Party? A dizzying whirl of uncertainty. Some guests prefer a ride that falls between these extremes. The same applies to annuity buyers—many seek an option that provides more potential growth than a Multi-Year Guarantee Annuity (MYGA) but without the return volatility of a Fixed Indexed Annuity (FIA). Finding this middle ground has been a challenge—until now.

The Balance Between MYGAs and FIAs

A MYGA offers predictability and minimal risk, making it a secure choice. However, some clients may desire higher returns. On the other hand, FIAs provide principal protection with the potential for higher upside but come with the risk of years with no returns, making them less appealing to risk-averse investors.

Clients need a solution that offers principal protection while ensuring a positive return every year, eliminating the risk of earning zero in certain periods. They also seek an alternative that removes cap rate renewal risk. Fortunately, such a solution exists.

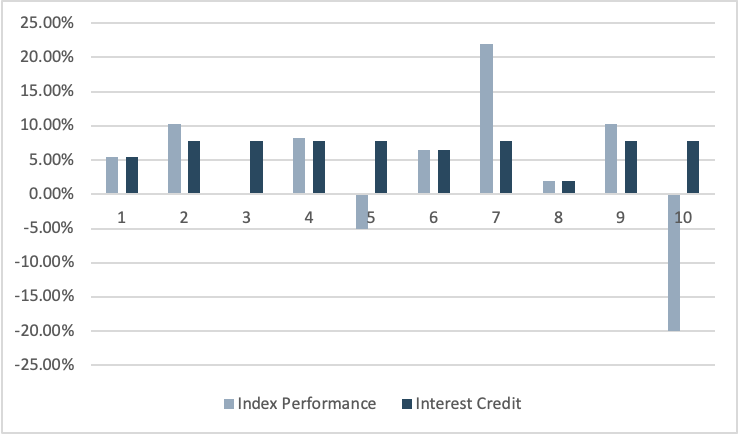

Figure 1: Trigger Mechanics

Figure 1 demonstrates how the returns are less volatile, but what about the overall performance? With volatility between the typical MYGA and FIA, actual returns will likely land in the same place: Somewhere between the typical MYGA and FIA available in today’s market.

Reducing Volatility in an FIA

The first step in minimizing volatility is leveraging the FIA’s built-in 0% floor, ensuring that losses are avoided. However, this does not eliminate the possibility of a year with no growth. For some clients—especially those with moderate risk tolerance—exchanging some upside potential for a guaranteed return every year is a trade-off they willingly accept. They prefer a smoother experience rather than an unpredictable ride.

The solution? A slightly lower cap rate, guaranteed for the contract’s duration, combined with a trigger mechanism. The trigger activates if the market experiences a zero or negative return, providing a modest guaranteed return. This ensures the client consistently earns a positive return, avoiding the unpredictability of traditional FIAs.

Performance and Stability

With volatility positioned between a MYGA and a typical FIA, this product’s expected returns will likely fall within that same range. Moreover, by locking in cap rates for 7, 10, or even 20 years, this structure removes a major concern of traditional FIAs: cap rate renewal risk. Clients benefit from consistency and predictability throughout the contract period.

Ultimately, this new annuity option introduces a more nuanced approach to risk tolerance, offering a stable and suitable choice for clients seeking financial growth without the highs and lows of traditional FIA products. This solution provides a ride worth taking for those looking for a middle ground.

Annuities Are Like Theme Park Rides!

Picture this: You’re at Disneyland. Do you prefer a gentle, predictable cruise through It’s a Small World… or the dizzying, unpredictable spins of the Mad Tea Party? Now, imagine annuities the same way:

MYGAs = Safe, steady, and reliable.

FIAs = Exciting, but some years might bring zero returns.

But what if you want something in the middle?

A new annuity solution combines principal protection, locked-in cap rates, and positive annual returns each year—no more worrying about market swings ruining your year!

If your clients want growth without the nausea, it’s time to explore this middle ground!

#Annuities #RetirementPlanning #FinancialAdvisors #RiskManagement #SmartInvesting

Subject Line: A Better Annuity for Clients Who Want a Smoother Ride

Have you ever had a client who wants more growth than a MYGA but doesn’t want the uncertainty of an FIA? We’ve all been there. Finding that middle ground has been a challenge—until now.

There’s a new annuity option that solves this dilemma by offering:

- Principal protection – No market losses

- Positive annual returns – Even in flat or down years

- Fixed cap rates for up to 20 years – No renewal surprises

- Smoother, more predictable performance

Think of it like a theme park ride—some clients want excitement, others want predictability. This option gives them steady growth without the market whiplash.

Let’s catch up soon—I’d love to walk you through the details! Let me know when you’re free.

Best,

[Your Name and Contact Information]