Welcome

DIY BRANDABLE CAMPAIGNS

Everything you need to create your own marketing campaigns using our brandable templates and campaign assets. To get started, click the asset you would like to use below. Highlight and right-click the text, select Copy, and then paste the text into your website, email, or social media sites.

CAMPAIGN ASSETS

The conventional approach to designing accumulation-focused Indexed UL strategies involves minimizing the death benefit. Often, this is combined with using the maximum AG49-compliant illustrated rate to squeeze every dollar of projected income out of the product.

While that can produce a compelling illustration, it may not be the most effective approach in the real world. That thought process is often the reason for stress testing or reducing the illustrative rate, even if it results in a reduced illustrative income. The truth is there is another, perhaps more meaningful, alternative design that can deliver more consumer value from virtually any Indexed UL product.

This more balanced approach to case design can deliver:

- An increased initial face amount, meaning more coverage for the client’s loved ones

- A corresponding increase in the lifetime maximum available under any Accelerated Benefit Riders

- Additional funding capacity that allows the client to increase their contributions to the “Tax-free Bucket” in their retirement plan should their investable cash flow increase

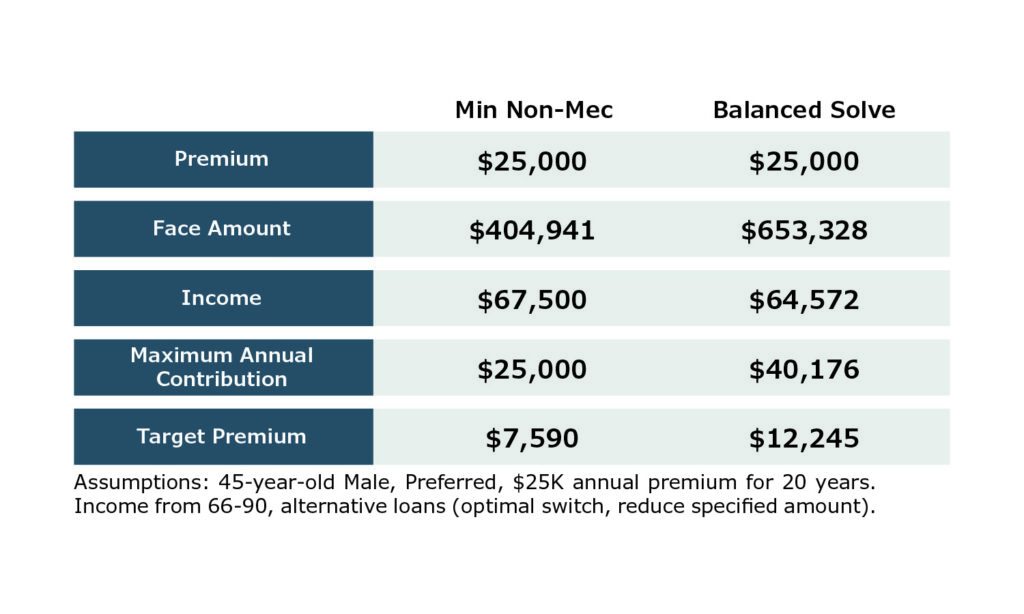

All without asking the client for another dollar of premium. Check out the results below:

What’s the Bottom Line?

An additional $248,387 in coverage, an increase of over 61% versus a traditional design. The product includes a Chronic Illness ABR that is now based on a 61% larger face amount, putting more cash at the client’s fingertips when they need it most:

- Traditional Design: $404,941 Maximum Lifetime Benefit

- Balanced Approach: $653,328 Maximum Lifetime Benefit, an 81% increase

How Does this Impact Illustrated Income?

Over $14,000 in additional funding capacity per year. Remember, all the testing that limits how much premium you can contribute “rolls” forward. By the 10th policy year, there will be a whopping $140,000 in additional funding capacity.

What’s in it for the Advisor?

As the face amount increases, so does the Target Premium. Using this consumer value-packed approach increases Target Premium by 61%!

What Products Work with This Approach?

This strategy likely works with most accumulation-focused IUL and VUL products. Case design will be a manual process. Increasing the face amount from a maximum accumulation solve by 50% might be a good starting point.

The conventional approach to designing accumulation-focused Indexed UL strategies involves minimizing the death benefit. Often, this is combined with using the maximum AG49-compliant illustrated rate to squeeze every dollar of projected income out of the product. While that can produce a compelling illustration, it may not be the most effective approach in the real world.

Interested in learning more? Let’s chat!

#LifeInsurance #Section7702 #RetirementPlanning

Subject Line: Designing IUL for Long-Term Accumulation

The conventional approach to designing accumulation-focused Indexed UL strategies involves minimizing the death benefit. Often, this is combined with using the maximum AG49-compliant illustrated rate to squeeze every dollar of projected income out of the product.

While that can produce a compelling illustration, it may not be the most effective approach in the real world. That thought process is often the reason for stress testing or reducing the illustrative rate, even if it results in a reduced illustrative income. The truth is there is another, perhaps more meaningful, alternative design that can deliver more consumer value from virtually any Indexed UL product.

This more balanced approach to case design can deliver:

- An increased initial face amount, meaning more coverage for the client’s loved ones

- A corresponding increase in the lifetime maximum available under any Accelerated Benefit Riders

- Additional funding capacity that allows the client to increase their contributions to the “Tax-free Bucket” in their retirement plan should their investable cash flow increase

All without asking the client for another dollar of premium.

If you want to take a closer look at how we’re designing this strategy with other advisors, reach out to me for more information.