Welcome

DIY BRANDABLE CAMPAIGNS

Everything you need to create your own marketing campaigns using our brandable templates and campaign assets. To get started, click the asset you would like to use below. Highlight and right-click the text, select Copy, and then paste the text into your website, email, or social media sites.

CAMPAIGN ASSETS

Exit Strategies in Indexed Universal Life

The shifting landscape of economic conditions continually influences the appeal of permanent life insurance products. While newly issued policies can adapt to prevailing market dynamics, in-force policies often face the challenge of underperformance relative to initial sales illustrations. This reality places financial advisors in the difficult position of managing client expectations and navigating potential solutions. However, a well-structured policy can offer built-in flexibility, mitigating the need for reactive course corrections.

The Challenge of Performance Variability

Advisors familiar with permanent life insurance products understand the inherent volatility of projected versus actual performance. The historical trend of declining dividend rates in Whole Life (WL), market-dependent returns in Variable Universal Life (VUL), and fluctuating cap and participation rates in Indexed Universal Life (IUL) all illustrate this challenge. These factors do not necessarily render any of these products unsuitable but underscore the importance of flexibility in adapting to evolving market conditions.

One potential answer? A strategic approach within the VUL space that incorporates elements of downside protection traditionally associated with IUL.

The Evolution of Market-Linked Life Insurance Strategies

The rise of downside-protected products offering market-based returns has gained traction due to their appeal to loss-averse clients. While IUL has traditionally filled this niche, its reliance on cap and participation rates makes it vulnerable to declining performance in extended low-rate environments. Policyholders dissatisfied with these limitations often face two choices: maintaining their current policy or transitioning to a new product. However, this presents obstacles such as insurability and surrender charges, making a seamless transition an ideal alternative.

A Built-in Solution: The Flexibility of Indexed Subaccounts in VUL

Fortunately, many modern VUL policies incorporate indexed subaccounts, blending the core advantages of IUL with VUL’s inherent flexibility. Additionally, widely adopted in the variable annuity space, buffered strategies have now been introduced in VUL products, offering clients a spectrum of downside protection options while maintaining upside potential.

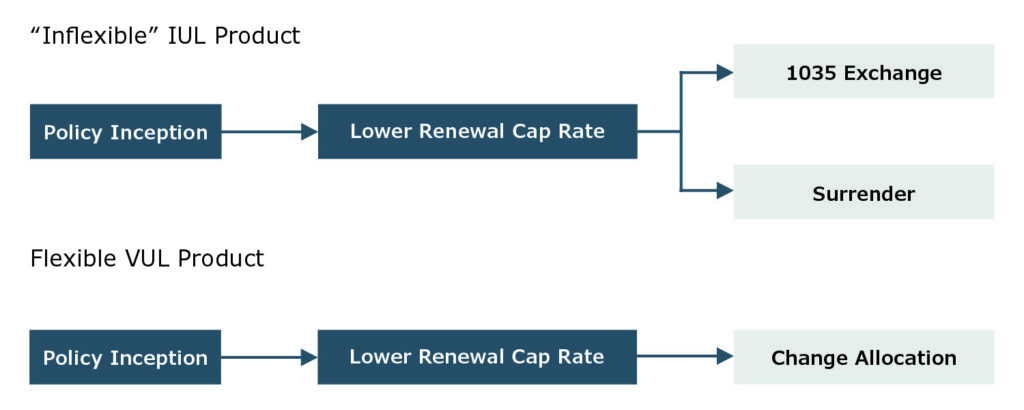

Clients holding a VUL with indexed subaccounts or buffered strategies are positioned favorably. Should cap rates decline to the point where returns become unattractive, policyholders can reallocate funds within their existing policy. Unlike IUL, which is constrained by the renewal terms set by the insurer, VUL allows adjustments to subaccount allocations, offering adaptability without requiring new underwriting or surrendering the policy.

Practical Allocation Strategies for Changing Market Conditions

Financial advisors can guide clients through reallocations tailored to their evolving risk tolerances and return objectives. If a client seeks greater upside potential, shifting to a more aggressive market-based subaccount may be appropriate. Conversely, if predictability is the priority, reallocating to a fixed account or a bond-focused subaccount could provide stability. Crucially, this decision is not binary—clients can diversify their policy allocations across multiple subaccounts to optimize their portfolio’s risk-reward balance.

See Figure 1, below, for additional details on the difference between an IUL and VUL in these circumstances.

Figure 1: Strategies for a Falling Cap Rate

Positioning Clients for Long-Term Success

Financial advisors should emphasize flexibility rather than attempting to predict the best-performing life insurance product at any given moment. Due to economic shifts, the most favorable product today may not hold that position in a few years. VUL with indexed subaccounts and buffered strategies provides an inherent exit strategy, allowing clients to adapt without policy replacement or additional underwriting hurdles.

By leveraging VUL’s built-in flexibility, advisors can equip clients with a more resilient insurance solution, ensuring their financial strategy remains effective despite market fluctuations.

The changing economic landscape means insurance advisors must help clients navigate the unpredictable world of permanent life insurance. Whether it’s the volatility of Whole Life, the market-based returns of Variable Universal Life (VUL), or the cap-and-participation rate challenges of Indexed Universal Life (IUL), one thing is clear: flexibility is key.

One solution? Modern VUL policies with indexed subaccounts or buffered strategies. These offer the flexibility to adapt to market shifts without requiring new underwriting or policy replacement.

The power of this flexibility allows clients to avoid the pitfalls of underperformance while adapting to their evolving needs, whether they’re seeking higher upside potential or more stability. Don’t just stick to what’s worked in the past—focus on adaptability for long-term success!

Interested in learning more? Let’s chat!

#InsuranceStrategies #VUL #IUL #FinancialPlanning #InsuranceAdvisors #MarketAdaptability #ExitStrategies #ClientSuccess

Subject Line: Unlock Flexibility in Life Insurance Strategies for Your Clients

In today’s ever-changing economic climate, it’s more important than ever for financial advisors to offer clients insurance solutions that provide flexibility and adaptability. Whether dealing with declining dividend rates, market fluctuations, or cap limitations, it’s crucial to position clients with products that allow them to adjust as market conditions evolve.

One strategy that stands out is using Variable Universal Life (VUL) policies with indexed subaccounts or buffered strategies. These modern VUL options offer the best of both worlds: the upside potential of market-linked returns and downside protection, allowing your clients to adjust their allocations without needing new underwriting or policy replacement.

As you know, flexibility is key. With these products, your clients can reallocate their investments as their needs shift, ensuring they’re always on track to meet their long-term goals without the hassle of surrendering policies or facing insurability challenges.

I’d love to discuss how you can implement these strategies into your practice and offer your clients a more resilient insurance solution.

Best regards,

[Your Contact Information]